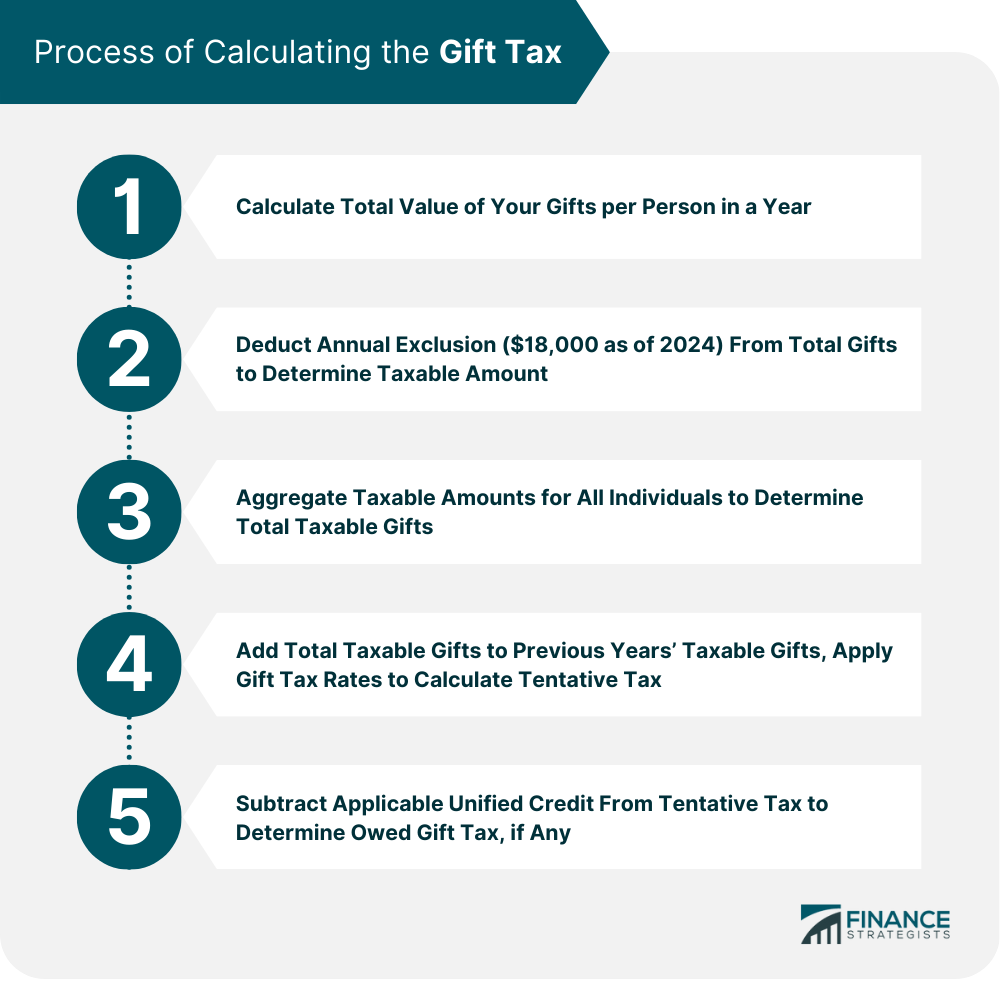

Annual Gift Tax Limit 2025. In 2024, the exclusion amount is $18,000 per person. Republicans, who will have full control of the white house, house and senate in the new year, have big plans to extend trump’s 2017 tax cuts and other priorities but debate over how to pay for them.

This means individuals can give up to this amount to any number of people without triggering federal gift tax. The unified estate and gift tax exclusion amount, $13,610,000 for gifts made and decedents dying in 2024, will be $13,990,000 for gifts made and decedents dying in 2025.

Annual Gift Tax Limit 2025 Images References :

Source: zoelyman.pages.dev

Source: zoelyman.pages.dev

Gift Tax 2025 Limit 2025 Zoe Lyman, In 2025, the annual gift exclusion will rise to $19,000 per recipient —an increase from the $18,000 limit in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, This means you can gift up to $19,000 to each person in your life without needing to file a gift tax return.

Source: ryangreene.pages.dev

Source: ryangreene.pages.dev

How Much Can You Gift Tax Free 2025 Ryan Greene, This means individuals can give up to this amount to any number of people without triggering federal gift tax.

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, In other words, giving more than $19,000 to any individual in 2025 means you may have to file a gift tax return.

Source: zoelyman.pages.dev

Source: zoelyman.pages.dev

Gift Tax 2025 Limit 2025 Zoe Lyman, Contributions above this amount count against your lifetime gift tax exemption, set at $13.99 million in 2025.

Source: williambower.pages.dev

Source: williambower.pages.dev

2025 Gift Amount Allowed William Bower, Under section 56(2)(x) of the income tax act, gifts received by an individual are taxable if their aggregate value exceeds ₹50,000 in a financial year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For the 2025 tax year, the annual gift tax exclusion is increased by $1,000 to a total of $19,000.

Source: jackieasesibylla.pages.dev

Source: jackieasesibylla.pages.dev

Annual Gift Tax Limit 2025 Freda, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married couples, the combined 2024 limit is $36,000.

Source: jackieasesibylla.pages.dev

Source: jackieasesibylla.pages.dev

Annual Gift Tax Limit 2025 Freda, Married taxpayers can combine their gift tax exclusion as they can share their two annual exclusions.

Source: jackieasesibylla.pages.dev

Source: jackieasesibylla.pages.dev

Annual Gift Tax Limit 2025 Freda, In other words, giving more than $19,000 to any individual in 2025 means you may have to file a gift tax return.